India's Economic Position

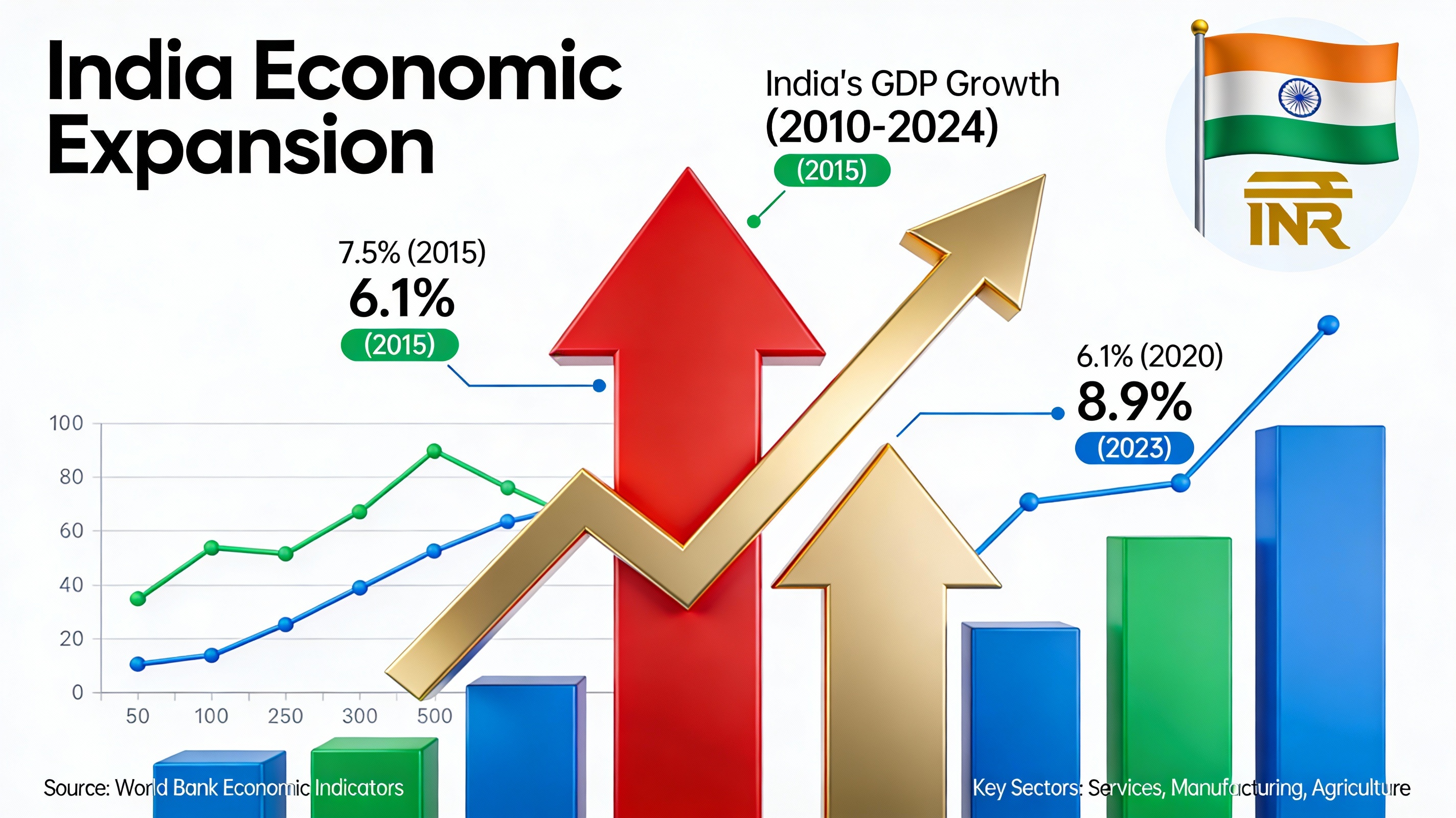

India has emerged as the 5th largest economy globally, driven by structural reforms, favorable demographics, expanding services sector, and manufacturing growth. The equity markets have demonstrated resilience with a 10.4% CAGR over the past 15 years, reflecting investor confidence in India's long-term growth potential.

Key Economic Indicators

Market Highlights Today

5th Largest Economy

India has surpassed major developed economies to claim the 5th position globally on nominal GDP basis, reflecting the pace of economic transformation over the past decade.

Structural Reforms Drive Growth

Liberalized FDI policies, GST implementation, labour law reforms, and digital infrastructure expansion have created a competitive business environment attracting global investment.

Demographic Dividend

With median age of 28 years and 1.4+ billion population, India has a young, growing workforce entering prime productive years, supporting sustained growth potential.

Services Sector Strength

IT services, financial services, and business process outsourcing contribute 55%+ of GDP, making India a global hub for knowledge-based industries.

Manufacturing Growth

PLI schemes and Make in India initiatives are driving manufacturing expansion, targeting 12-15% CAGR and global supply chain diversification.

Market Performance

Equity markets delivered 10.4% CAGR over 15 years. Strong domestic savings and institutional participation provide stable base for continued wealth creation.

Why India's Economy Is Growing

🔧 Structural Reforms & Policy Framework

India has undertaken comprehensive economic reforms that have transformed the business environment and attracted sustained foreign investment.

- GST unified 27+ tax regimes into single indirect tax system, reducing compliance burden

- Labour law reforms streamlined hiring/firing, encouraging formal employment expansion

- 100% FDI allowed in many sectors; foreign investors benefit from scale and growth

- Digital infrastructure (UPI, fintech) enabling rapid financial inclusion

- Bankruptcy & insolvency reforms improving corporate governance and creditor rights

👥 Demographic Dividend: India's Workforce Advantage

India's young population profile provides a powerful growth tailwind compared to aging developed economies and even China.

- Working-age population (15-64) will peak around 2040, supporting high consumption and savings

- Consumer demand expansion: 200+ million entering middle class over next 20 years

- Labour-intensive manufacturing advantage: competitive wage costs vs China, better demographic profile

- Startup ecosystem benefit: young, tech-savvy talent fueling innovation and entrepreneurship

- Skills development: government focus on vocational training and higher education capacity building

🏢 Services Sector: India's Growth Engine

The services sector, particularly IT and business services, has been the cornerstone of India's economic growth and employment generation.

- IT services: Global tech companies use India for R&D, software development, and digital transformation

- Business process outsourcing: Finance, HR, legal services offshored to cost-competitive India

- Financial services: Growing insurance, banking, and capital markets sectors

- Telecom & digital services: Mobile penetration 88%+, enabling fintech and digital commerce

- Export growth: Services exports grew 8%+ CAGR in past decade, building hard currency reserves

🏭 Manufacturing Growth: Supply Chain Shift

Global manufacturing is shifting from China to India due to geopolitical factors, trade policies, and India's competitive advantages.

- PLI scheme offering incentives for high-value manufacturing in 14+ sectors

- FDI inflows in manufacturing have surged post-2020 with US, Japan, South Korea diversifying from China

- Electronics manufacturing: phones, semiconductors, components production ramping up

- Pharma advantage: India supplies 20%+ of global generic drugs; vaccine manufacturing capacity world-leading

- Textiles & apparel: Low labour costs and established supply chains attracting orders from China-weary buyers

📊 Equity Markets: 10.4% CAGR Demonstration

Indian equity markets have delivered strong long-term returns, attracting domestic and foreign capital and supporting corporate growth.

- Market cap grew from ~₹30 lakh crore (2010) to ₹400+ lakh crore (2025), reflecting GDP + valuation expansion

- Domestic retail participation increased significantly; retail investors now 60%+ of equity market participation

- FIIs (Foreign Institutional Investors) provide stable foreign capital inflows; DII (Domestic Institutional Investors) growing faster

- Banking and IT sectors have been growth engines; PSU reforms and privatization creating value

- Strong corporate earnings growth: Sensex component companies delivered 12-13% earnings CAGR in past decade

Key Growth Sectors: India's Economic Pillars

💻 IT & Services

Contribution: 8-10% of exports, 10M+ jobs, 12%+ CAGR

Outlook: Digital transformation, AI/Cloud adoption, data analytics growth

🏥 Pharma & Healthcare

Contribution: 20% of global generics, vaccine hub, growing healthcare spend

Outlook: Biotech boom, hospital chains, telemedicine expansion

⚡ Energy Transition

Contribution: 175 GW renewable capacity, EV push starting

Outlook: Net zero 2070 target, renewable manufacturing, battery tech

🏦 Financial Services

Contribution: 7-8% of GDP, banking expansion, fintech surge

Outlook: Digital payments 90%+, insurance penetration rising, wealth management

Key Economic Metrics at a Glance

PYQs: India's Economy & Growth (For Aspirants)

Prompt: Examine the factors that have enabled India to rise to the 5th position in global GDP rankings. Discuss the role of structural reforms, demographics, and sectoral diversification.

Answer Structure:

- Context: India's economic position 10 years ago vs today; comparative advantage vs peers

- Structural reforms: GST, FDI liberalization, labour laws, bankruptcy code, PLI schemes

- Demographic dividend: young workforce, consumer expansion, global competitiveness

- Sectoral pillars: IT services, pharma, manufacturing shift, energy transition

- Policy initiatives: Make in India, Atmanirbhar Bharat, Digital India, renewable energy push

- Challenges ahead: skill gaps, infrastructure needs, income inequality, environmental sustainability

- Conclusion: sustained growth potential but reforms must be deepened and broadened

Prompt: Analyse how India's demographic structure presents both opportunities and challenges. What policies are needed to harness the dividend and avoid a "divide"?

Answer Structure:

- Define demographic dividend; explain why India is well-positioned vs China, Japan, US

- Opportunities: Large working-age population, consumer demand, wage competitiveness for manufacturing

- Challenges: Need for skill development, job creation, healthcare access, education quality

- Policy needs: Vocational training expansion, labour market reforms, higher education scaling, skill certification

- Regional disparities: gaps between rural-urban, gender-wise participation in workforce

- Demographic dividend window: 2030-2040 window, after which aging will accelerate

- Conclusion: India must act now to invest in human capital; else dividend becomes liability

Prompt: Evaluate the role of the services sector in India's economic growth. What are the implications for employment, exports, and regional development?

Answer Structure:

- Services contribution: 55%+ of GDP, 8-10% of exports, 30%+ of employment

- Sub-sectors: IT services (flagship), BPO, financial services, telecom, hospitality, healthcare

- Export competitiveness: English-speaking workforce, technical expertise, cost advantage, time zone benefit

- Employment: Skilled job creation, wage premiums for IT professionals, labour migration to metros

- Regional impact: Concentration in metros (Bangalore, Hyderabad, Mumbai, Pune) vs lagging regions

- Challenges: Skill gaps, attrition rates, dependence on US market, wage inflation, brain drain risks

- Future outlook: AI disruption, upskilling needs, diversification to Tier-II cities, focus on domestic market

Prompt: Discuss how strong domestic savings and equity market performance have contributed to India's economic growth. What are the risks to this model?

Answer Structure:

- Savings rate: India's gross domestic savings at 32-34% of GDP, among highest globally

- Equity market participation: Retail investors now 60%+ of trading volume; SIP culture growing

- 10.4% CAGR performance: demonstration of India's economic resilience and corporate earnings growth

- Wealth creation: market cap growth from ₹30L cr (2010) to ₹400L+ cr (2025)

- Domestic institutional participation: Insurance companies, mutual funds, banks providing stable capital

- Risks: Valuation concerns, FIU volatility, concentration in few stocks/sectors, retail investor losses during crashes

- Policy needs: investor protection, corporate governance improvement, market infrastructure strengthening

Prompt: Analyze the Production-Linked Incentive (PLI) scheme and its role in reviving India's manufacturing sector. Assess its effectiveness and criticisms.

Answer Structure:

- Context: China's dominance in global manufacturing; geopolitical push for supply chain diversification

- PLI scheme: incentive structure, 14+ sectors targeted, incentive rates (4-6% for most, 10-15% for high-value)

- Objectives: Attract FDI, boost domestic manufacturing, create jobs, reduce import dependence

- Progress: ₹35,000+ crore in approved projects, commitments from Apple, Samsung, Sony, others

- Sectors benefiting: Electronics, pharmaceuticals, textiles, automotive, chemicals, batteries

- Criticisms: High subsidy burden, slower-than-expected implementation, skill gaps, infrastructure bottlenecks

- Way forward: combine PLI with infrastructure, skill development, and labour market reforms

Key Notes for Aspirants

Exam Strategy Tip: Always connect India's economic position with macro drivers—demographics, reforms, sectoral growth, and fiscal/monetary policy—to construct comprehensive GS answers.

- 5th Position Context: Nominal GDP basis; PPP ranking still 3rd; understand difference for UPSC

- Demographic Dividend: Peak window 2030-2040; requires investment in skilling and job creation

- Services Sector: India's competitive advantage; IT exports, BPO leadership, but needs diversification

- PLI & Make in India: Structural reform; combined with FDI liberalization, reshaping manufacturing landscape

- Equity Market Strength: 10.4% CAGR reflects underlying economic health; use as data point for long-term growth narrative

- Structural Reforms Impact: GST, labour laws, bankruptcy code transformed ease of doing business; reflect on state-level variation

- Regional Disparities: Growth concentrated in metros; coastal states; lagging regions need targeted policy attention

- Challenges Ahead: Infrastructure gaps, skill shortages, income inequality, environmental sustainability; balanced answer must acknowledge

Sources & Attribution

Data Sources (December 2025):

- IMF World Economic Outlook: Global GDP rankings, growth forecasts, economic indicators

- RBI Monetary Policy Reports: GDP growth, inflation, savings rates, financial indicators

- Ministry of Commerce & Industry: Trade data, FDI flows, PLI scheme progress, manufacturing data

- National Securities Depository Limited (NSDL): Market capitalization, equity market data

- United Nations World Population Prospects: Demographic data, median age, population projections

- Reserve Bank of India Annual Reports: Banking, fintech, financial inclusion metrics

Disclaimer: This content is educational and transformative. Always verify the latest economic data from official government/RBI sources before publishing. Attributions provided to maintain fair use and transparency.